Roth Ira Max Contribution 2024 Income Limits

Roth Ira Max Contribution 2024 Income Limits. You can leave amounts in your roth ira as long as you live. In 2024 you can contribute up to $7,000 or your taxable compensation.

The maximum total annual contribution for all your iras (traditional and roth) combined is: Roth ira contribution limits (tax year 2024) the charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

To Contribute To A Roth Ira (And Score Those Sweet Tax Advantages), You Have To Fall Within The Income Limits Set By The Irs.

Less than $146,000 if you are a single filer.

( Member Sipc ), And Its Affiliates Offer Investment Services And Products.

The account or annuity must be designated as a roth ira when it is set up.

Roth Ira Max Contribution 2024 Income Limits Images References :

Source: sayreqamelina.pages.dev

Source: sayreqamelina.pages.dev

How Much Can You Contribute To A Roth Ira 2024 Tybie Scarlet, You can leave amounts in your roth ira as long as you live. Roth ira income and contribution limits for 2024.

Source: kelsyqrosina.pages.dev

Source: kelsyqrosina.pages.dev

Roth Ira Max Contribution 2024 Over 50 Fae Kittie, 2024 max ira contribution limits over 50. In 2024 you can contribute up to $7,000 or your taxable compensation.

Source: caseyqludovika.pages.dev

Source: caseyqludovika.pages.dev

Max Roth Ira Contributions 2024 Libbi Othella, It’s relatively easy to exceed roth contribution limits. ( member sipc ), and its affiliates offer investment services and products.

Source: kelsyqrosina.pages.dev

Source: kelsyqrosina.pages.dev

Roth Ira Max Contribution 2024 Over 50 Fae Kittie, For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. Iras in 2024 have an individual contribution limit of $7,000, with an additional $1,000 allowed for earners 50+ years old.

Source: audrieblorrie.pages.dev

Source: audrieblorrie.pages.dev

Maximum 2024 401k Contribution Tarra Francine, The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older. This makes it important to plan.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older). Roth ira income and contribution limits for 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older). If you earned less than that, the limit.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Is A Backdoor Roth IRA A Good Move For Higher Earners?, What happens if you exceed contribution limits? You are allowed to contribute the full $7,000 to your roth ira if your modified adjusted gross income (magi) is less than $146,000 in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, In 2024 you can contribute up to $7,000 or your taxable compensation. It’s relatively easy to exceed roth contribution limits.

Source: skloff.com

Source: skloff.com

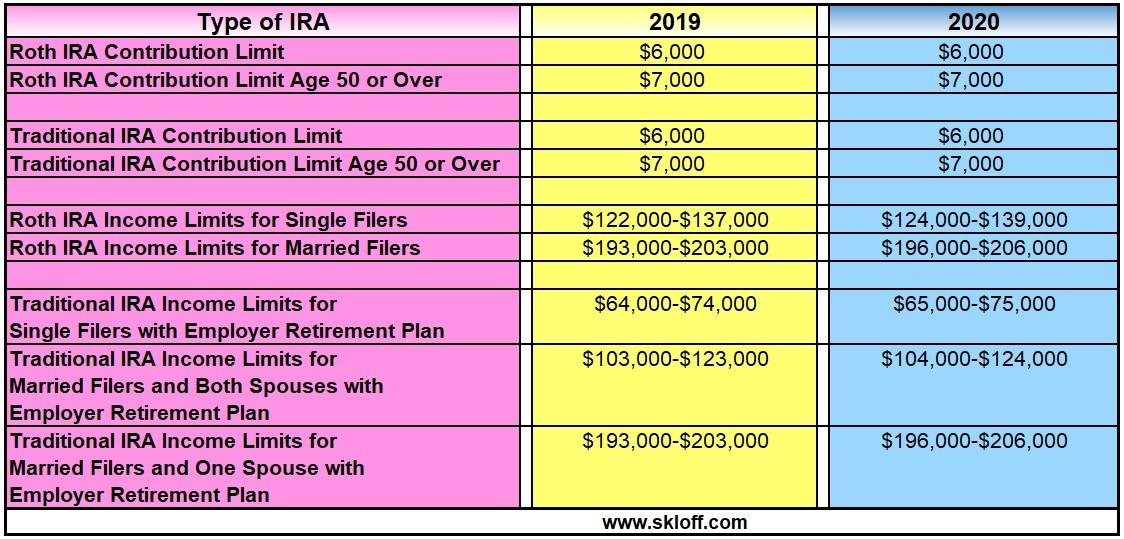

IRA Contribution and Limits for 2019 and 2020 Skloff Financial, Less than $230,000 if you are married filing jointly or a qualifying. You are allowed to contribute the full $7,000 to your roth ira if your modified adjusted gross income (magi) is less than $146,000 in 2024.

And If You Are Married.

That's up from $138,000 in 2023.

The Roth 401 (K) Contribution Limit For 2024 Is $23,000 For Employee Contributions And $69,000 Total For Both Employee And Employer Contributions.

The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

Posted in 2024