Medicare Tax Rate 2024 High Income

Medicare Tax Rate 2024 High Income. But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. It’s a mandatory payroll tax.

Pay a 30 per cent tax rate on each dollar earned. The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

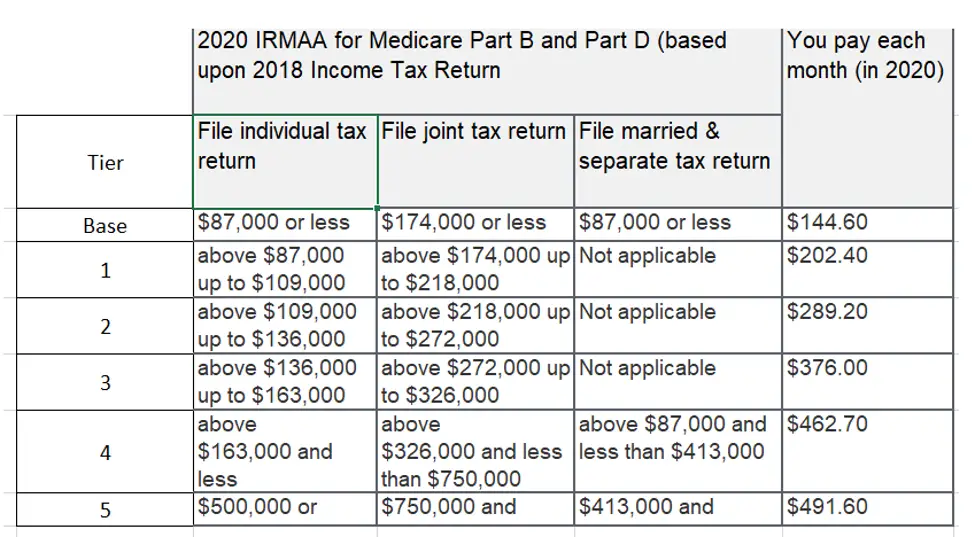

Irmaa Is A Surcharge That People With Income Above A Certain Amount Must Pay In Addition To Their Medicare Part B And Part D.

The rise in the cost of part d prescription drug plans will vary from state to state.

If You Have A Higher Income.

Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number.

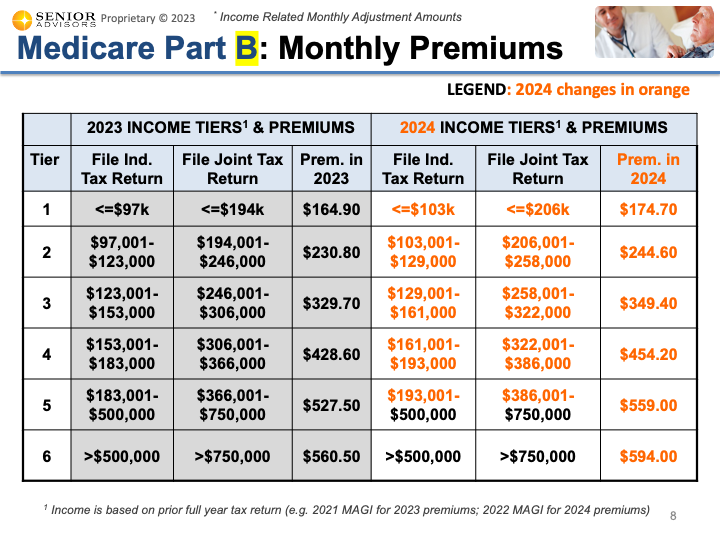

The Standard Monthly Premium For Medicare Part B Enrollees Will Be $174.70 For 2024, An Increase Of $9.80 From $164.90 In 2023.

Images References :

Source: asiaqcherise.pages.dev

Source: asiaqcherise.pages.dev

2024 Medicare High Surcharge Glori Kalindi, The fee kicks in if you make more than. The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible.

Source: gisellewbunny.pages.dev

Source: gisellewbunny.pages.dev

Medicare Premiums 2024 High Margy Saundra, Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number. For the 2024 tax year, those levels are:

Source: adriannawcherri.pages.dev

Source: adriannawcherri.pages.dev

Medicare Employee Tax Rate 2024 Lani Shanta, The current rate for medicare is 1.45% for the. The fee kicks in if you make more than.

Source: nicoleawdeanna.pages.dev

Source: nicoleawdeanna.pages.dev

2024 Tax Brackets Aarp Medicare Heda Rachel, For the 2024 tax year, those levels are: The budget proposes to increase the medicare tax rate on earned and unearned income.

Source: anjanetteweyde.pages.dev

Source: anjanetteweyde.pages.dev

Tax Brackets 2024 Calculator Bevvy, But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. The tax increase from 3.8% to 5% on earned and unearned income above $400,000 is part of a package of proposals aimed at extending the solvency of.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The medicare tax rate for 2023 and 2024 is 2.9% and is split between employees and their employer, with each paying 1.45%. For the 2024 tax year, those levels are:

Source: kateyqclarette.pages.dev

Source: kateyqclarette.pages.dev

2024 Tax Brackets And Deductions Jody Millisent, The budget proposes to increase the medicare tax rate on earned and unearned income. [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Are The Levels For Medicare Part B Premiums, But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. For 2024, the medicare surtax thresholds are set to impact single filers with an adjusted gross income (agi) above $200,000 and married couples filing jointly with an agi.

Source: summerstewart.z13.web.core.windows.net

Source: summerstewart.z13.web.core.windows.net

Medicare Preventive Services Chart 2024, In 2024, the medicare tax rate is 1.45%. The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

Source: elisabetwwilli.pages.dev

Source: elisabetwwilli.pages.dev

Irmaa 2024 Minni Quintina, For the 2024 tax year, those levels are: Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d.

Closing Medicare Tax Loopholes And Extending Solvency Of The Medicare Trust Fund Indefinitely By Expanding The Net Investment Income Tax On Income Over.

Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables.

The Rise In The Cost Of Part D Prescription Drug Plans Will Vary From State To State.

The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.