Futa Calculation 2025

Futa Calculation 2025. Noting that there is no space for approximation in the computation of gpa, the following formula is used: In 2025, there are expected changes to futa that businesses and individuals need to be aware of for tax planning purposes.

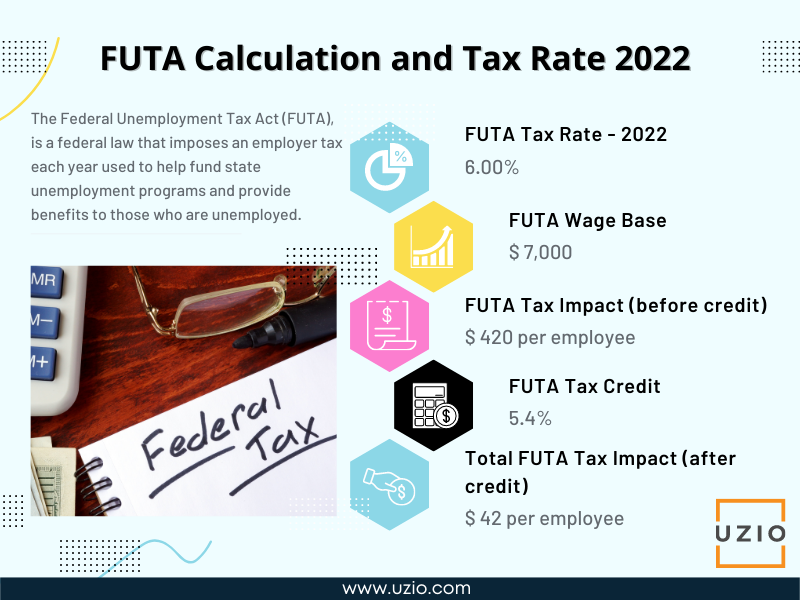

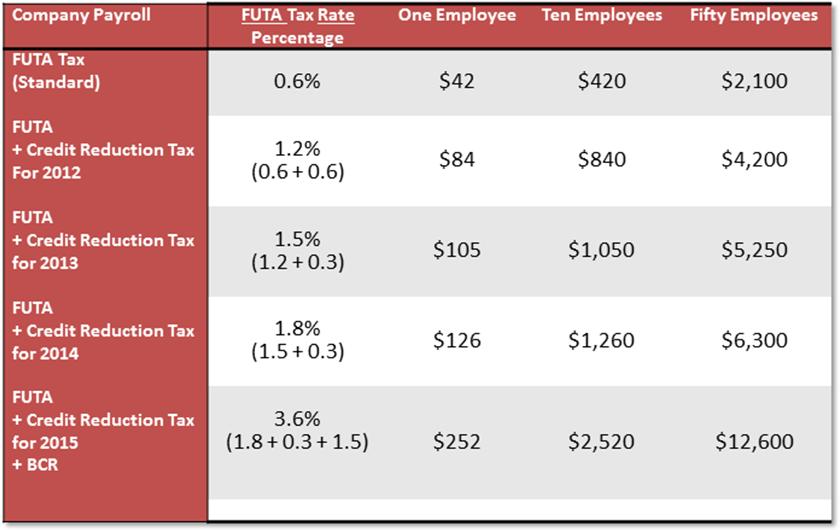

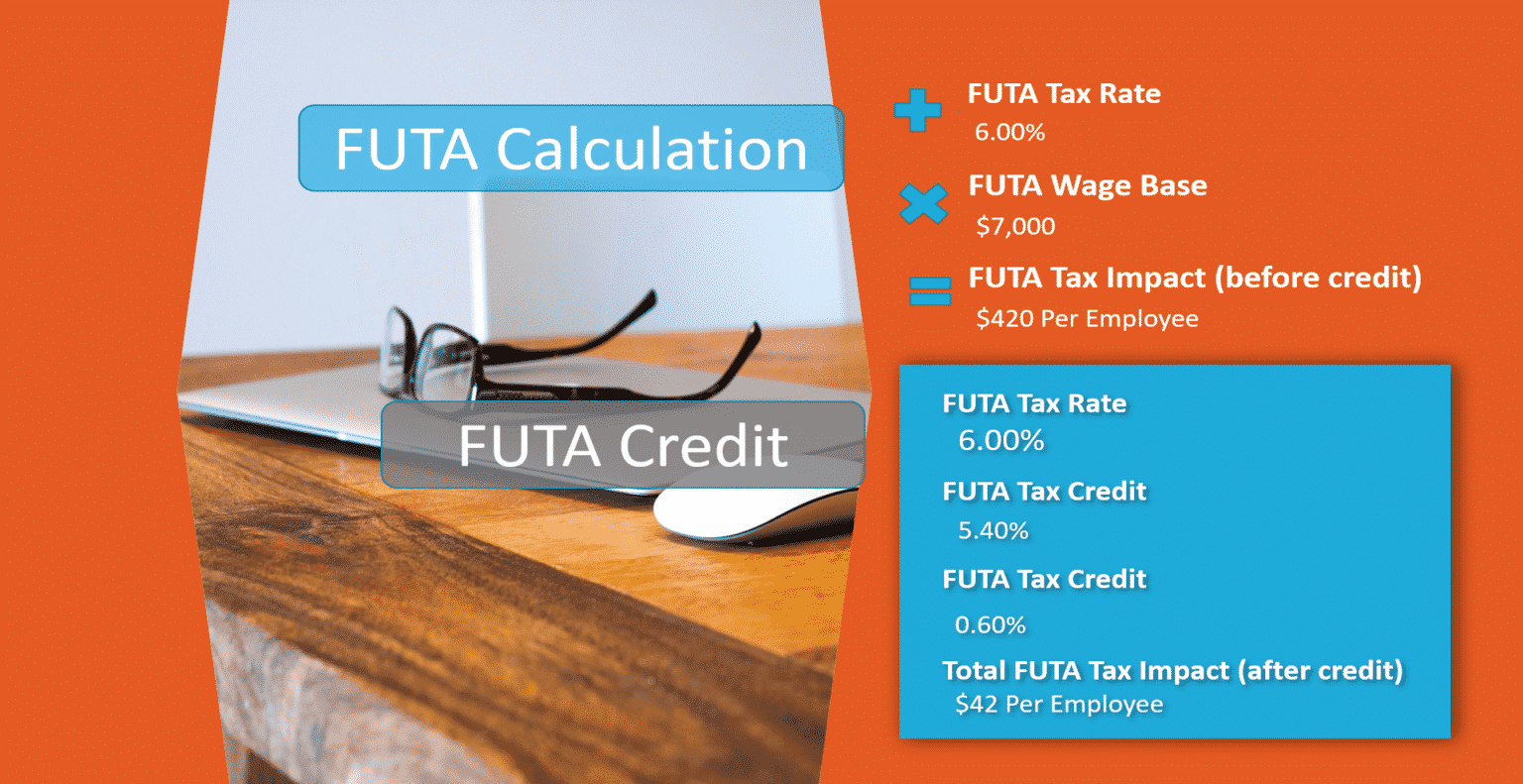

As of 2025, employers and employees each pay 6.2% for social security and 1.45% for. The futa tax rate for 2022 is 6.0%, and employers.

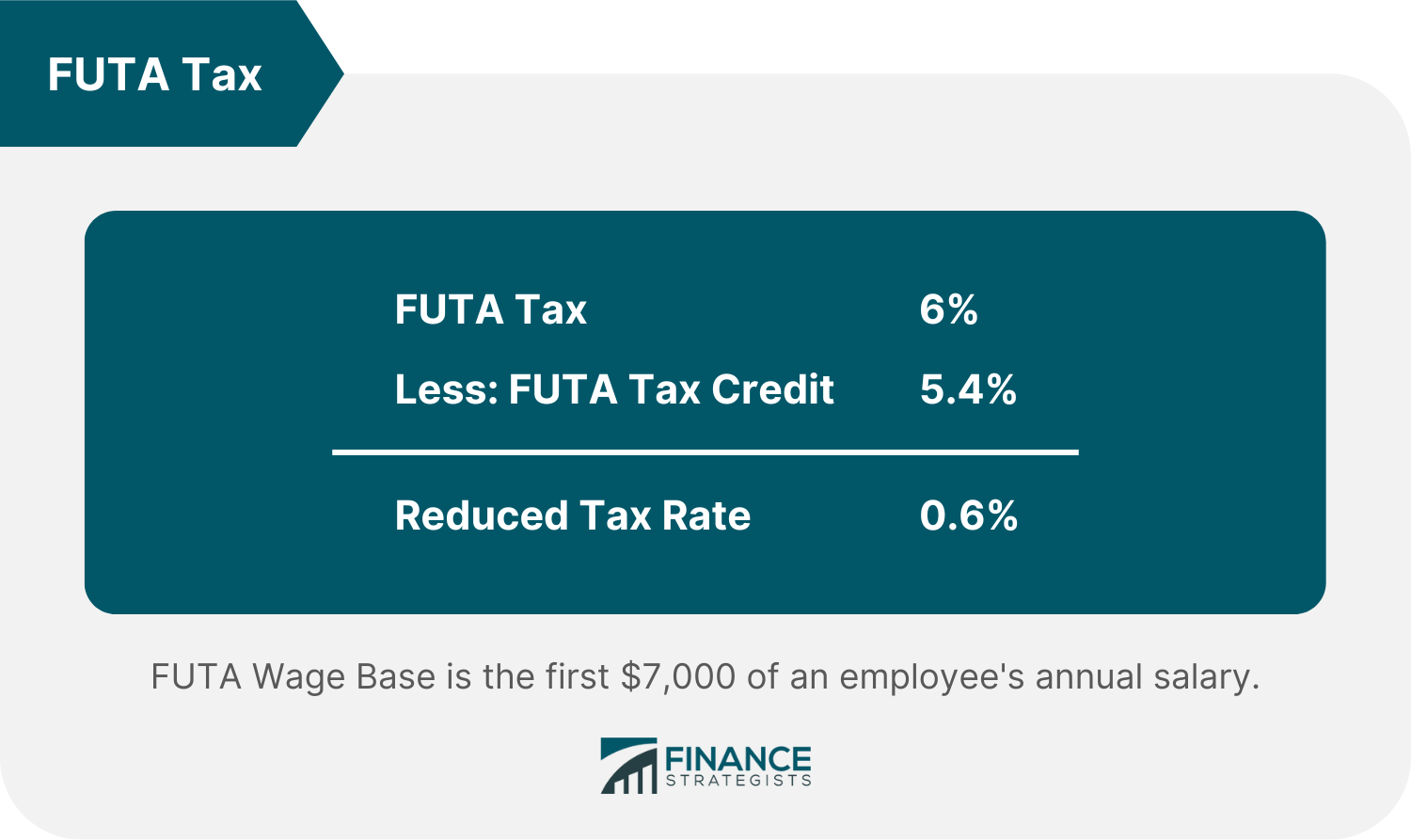

Federal Unemployment Tax Act (Futa):

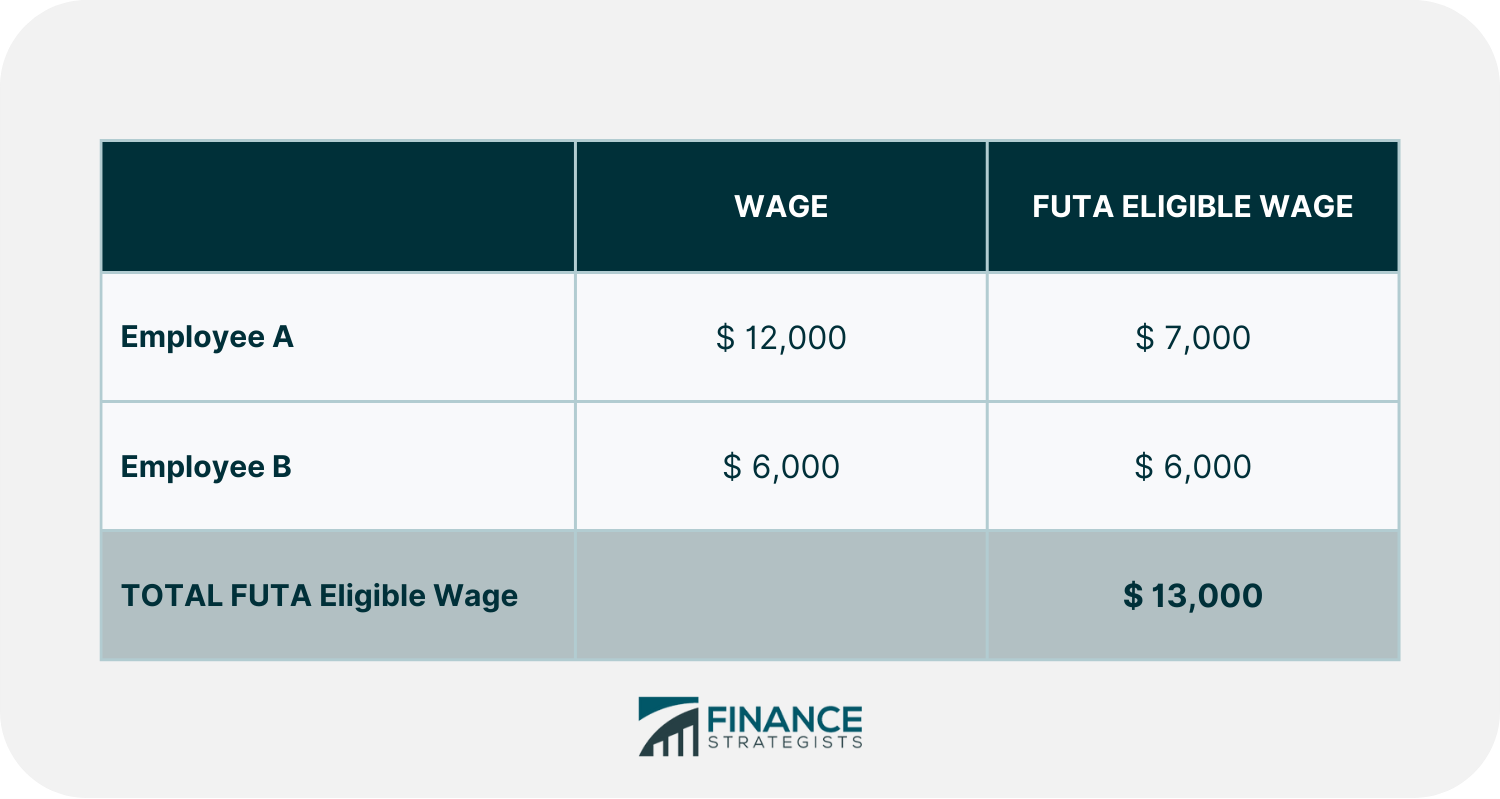

The tax only applies to this first $7,000.

First Semester Gpa = Total Points/Total Credit Units = 51/15 = 3.4.

In 2025, there are expected changes to futa that businesses and individuals need to be aware of for tax planning purposes.

Understanding The Federal Unemployment Tax Act (Futa) Futa Is A Federal Law That Raises Revenue To Administer Unemployment Insurance And Job Service Programs In Every State.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

Federal Unemployment Tax Act (FUTA) Definition & Calculation, A company is subject to futa taxes on the first $7,000 of wages paid to each employee. These changes may include adjustments in tax rates,.

Source: www.uzio.com

Source: www.uzio.com

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, An overview of the federal unemployment tax act. Citizens employed outside the u.s.

Source: www.financestrategists.com

Source: www.financestrategists.com

Federal Unemployment Tax Act (FUTA) Definition & Calculation, Overview, calculations, and tax rates. The futa tax rate for 2022 is 6.0%, and employers.

Source: www.accuchex.com

Source: www.accuchex.com

FUTA Tax Calculation Accuchex, An overview of the federal unemployment tax act. Noting that there is no space for approximation in the computation of gpa, the following formula is used:

Source: www.youtube.com

Source: www.youtube.com

Federal Unemployment Tax Act Calculation (FUTA)Payroll Tax, Understanding the federal unemployment tax act (futa) futa tax rates for 2022 & 2023 and taxable wage base limit. As of 2025, employers and employees each pay 6.2% for social security and 1.45% for.

Source: accuservepayroll.com

Source: accuservepayroll.com

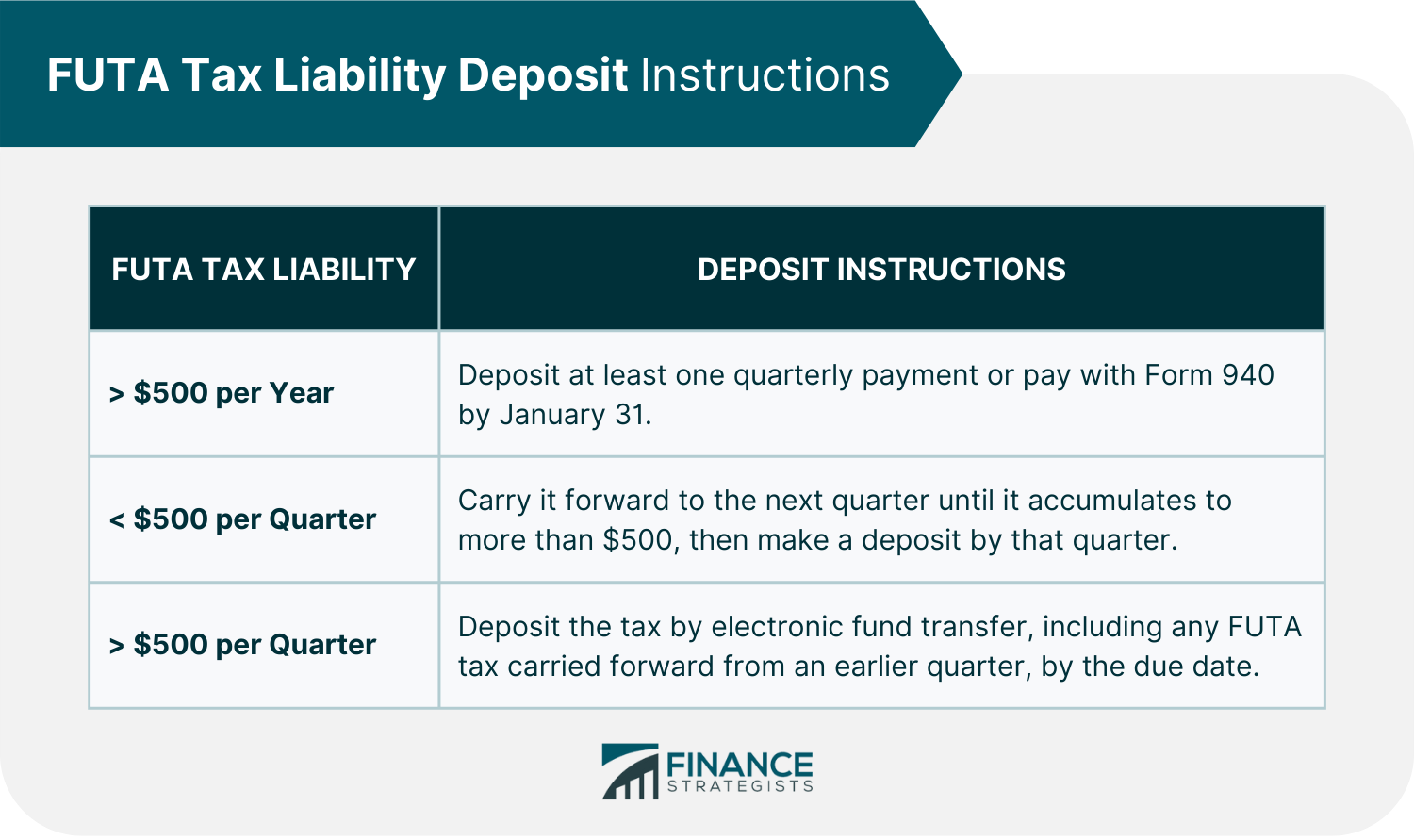

What is FUTA? Federal Unemployment Tax Rates and Information for 2022, In 2025, there are expected changes to futa that businesses and individuals need to be aware of for tax planning purposes. A company is subject to futa taxes on the first $7,000 of wages paid to each employee.

Source: ninasoap.com

Source: ninasoap.com

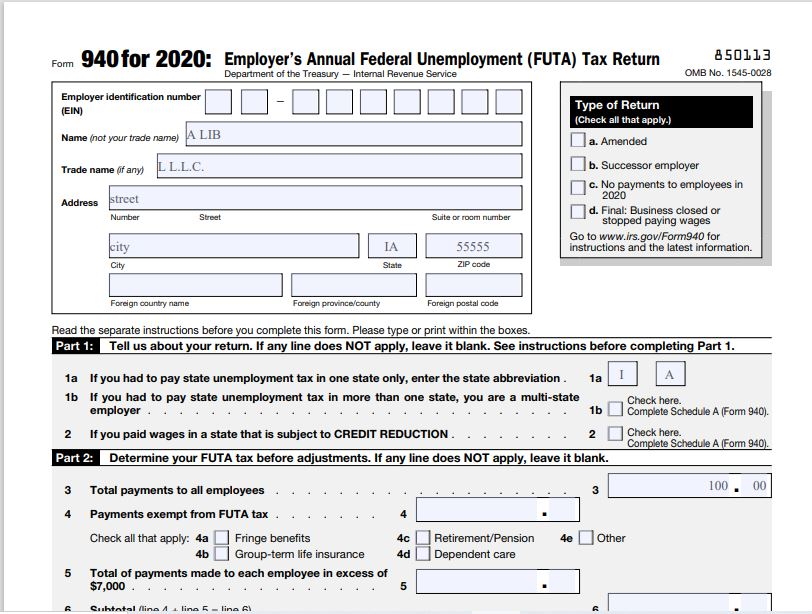

How to Complete 2020 Form 940 FUTA Tax Return Nina's Soap, Learn when and how to report futa tax returns. The current gross futa tax rate is 6.0% of taxable wages, to be paid by the employer only.

Source: www.financestrategists.com

Source: www.financestrategists.com

Federal Unemployment Tax Act (FUTA) Definition & Calculation, First semester gpa = total points/total credit units = 51/15 = 3.4. The 2025 futa tax rate is 6% of the first $7,000 from each employee's annual wages.

Source: www.chegg.com

Source: www.chegg.com

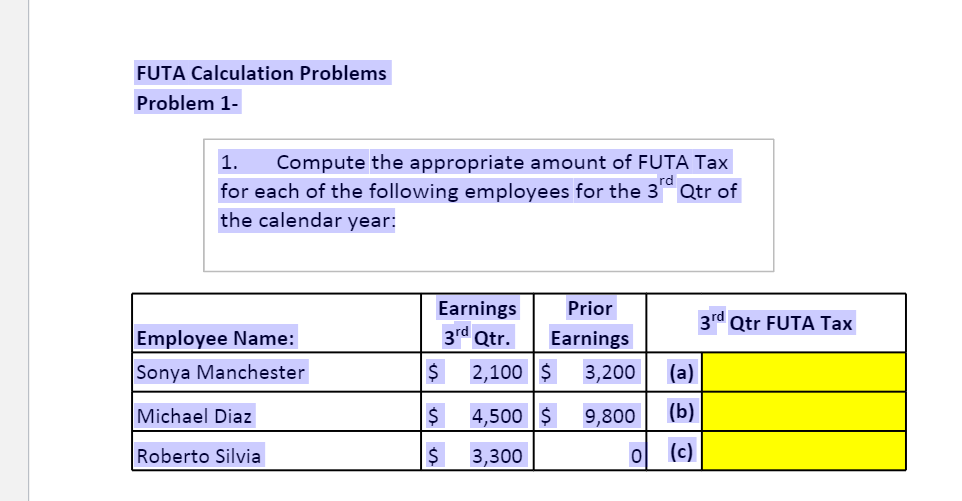

Solved FUTA Calculation Problems Problem 1 rd 1. Compute, What is state unemployment tax (suta)? However, an allowed credit effectively reduces the tax.

Source: investment-360.com

Source: investment-360.com

Understanding FUTA Definition and Calculation of FUTA Liability in the, As of 2025, employers and employees each pay 6.2% for social security and 1.45% for. First semester gpa = total points/total credit units = 51/15 = 3.4.

The Social Security Tax Is Based On Salaries Up To The Current Ceiling, Which For 2025 Is.

Overview, calculations, and tax rates.

Understanding The Federal Unemployment Tax Act (Futa) Futa Is A Federal Law That Raises Revenue To Administer Unemployment Insurance And Job Service Programs In Every State.

An overview of the federal unemployment tax act.